Dla mediów

- 31 Jul 2025

- ·

- Finance

Cellnex consolidates its growth: Organic Revenues up 6%, EBITDAaL up 8.1% and strengthens its financial position through the refinancing of its syndicated loan

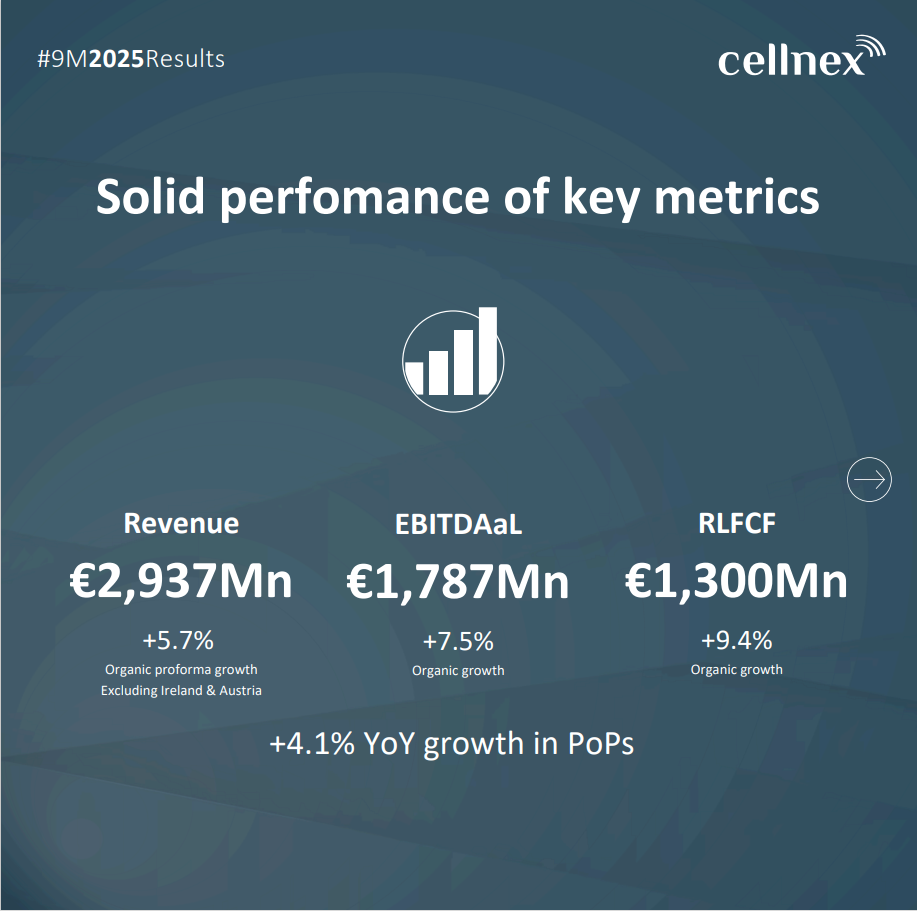

Organic growth in Points of Presence (PoPs) reached 4% YoY, reflecting steady network expansion.

The company successfully completed a €750 million seven-year bond issuance with a 3.5% coupon, and refinanced a €2.8 billion syndicated credit facility.

The Group remains committed to its strategic roadmap, prioritising organic and profitable growth, progressive debt reduction, and accelerating shareholder remuneration.

S&P has improved the rating outlook from stable to positive.

Barcelona, 31 July 2025.- Cellnex consolidates its growth in the first half of 2025. The company has released its financial results for the first half of 2025, highlighting sustained organic growth across its key operational and financial indicators.

During this period, in terms of organic growth (including organic revenues generated in the period only and excluding the contribution of Ireland, the foreign exchange market (FX), change of perimeter and others), revenues increased +6% and EBITDAaL +8.1%, reflecting the strength of the underlying business and increased operating leverage. Recurring Leveraged Free Cash Flow (RLFCF) rose to €832 million, compared to €781 million last year that represents a +6.5% increase. RLFCF per share increased 10.2%. To reinforce its financial capacity, the company successfully completed a €750 million bond issuance and refinanced a €2.8 billion syndicated credit facility, bringing total available liquidity to €4.9 billion. Additionally, Cellnex completed the buyback of 24 million shares, equivalent to 3.41% of its share capital. Reported revenues reached €1,942 million, compared to €1,921 million in the same period of the previous year, representing a +1.1% increase, impacted by the change of permitter of Austria and Ireland. For its part, EBITDAaL (EBITDA after leases) stood at €1,157 million, up +3.8% from €1,114 million in H1 2024.

Cellnex reiterates its 2025 guidance: Revenues between €3,950 and €4,050 million, Adjusted EBITDA between €3,275 and €3,375 million, RLFCF between €1,900 and €1,950 million and FCF between €280 and €380 million.

Marco Patuano, CEO of Cellnex, stated: “The results for the first-half of 2025 consolidate Cellnex’s organic growth trajectory, with sustained improvements in revenues and EBITDAaL”. He added: “The company has strengthened its capital structure through long-term debt issuance and syndicated loan refinancing, significantly enhancing our liquidity and financial flexibility. These actions, combined with disciplined execution of our strategic plan, position us to continue generating recurring value, optimising our risk profile, and accelerating shareholder returns”.

Industrial consolidation and strategic expansion

Organic growth in Points of Presence (PoPs) reached +4% YoY, with 1.5% from new colocations at existing sites and 2.5% from new towers deployments, driven primarily by Built-to-Suit (BTS) programs in France and Poland.

In the second quarter, Cellnex expanded its partnerships with ODIDO in the Netherlands, strengthening a 15-year strategic collaboration and reinforcing its position as a key partner for connectivity and digital transformation.

Performance by business line

In H1 2025, the company maintained stable performance across its core business areas:

- Telecom infrastructure services generated reported revenue €1,568 million, broadly in line with the previous year as a result of the deconsolidation of Ireland and Austria. Excluding the contribution of those countries, the organic revenue growth regarding the Towers business line represented a +5.2% increase.

- DAS, Small Cells, and network solutionscontributed €126 million, up +2.8%, reflecting growing demand in urban and high-density environments.

- Wholesale fiber, connectivity, and housing services saw strong growth, reaching €116 million (+20.8%), driven by expansion in other digital infrastructure services.

- Finally, Broadcasting revenues totalled €132 million, up +2%, reinforcing its role as a complementary business line.

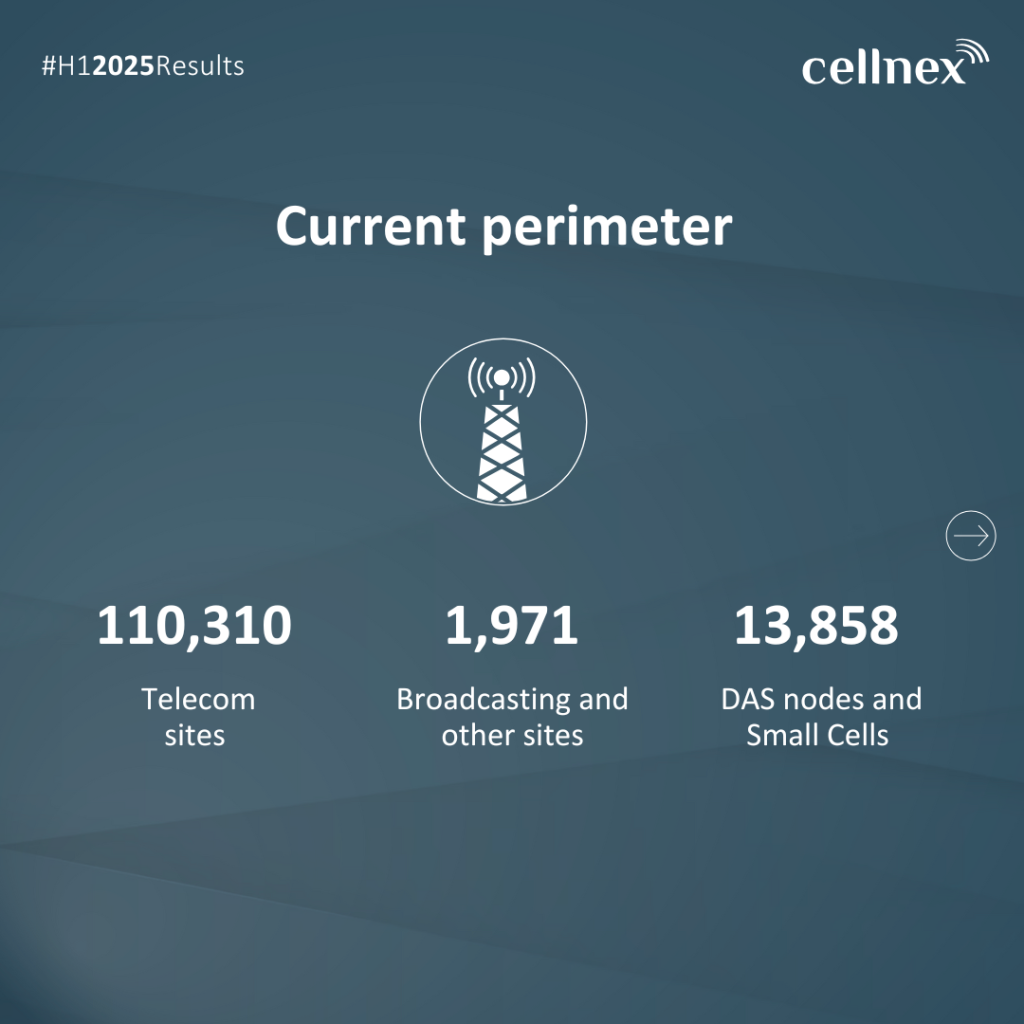

Site portfolio

As of 31 July, Cellnex operates 110,310 sites: 88,779 in its five core markets – 26,259 in France, 22,667 in Italy, 17,323 in Poland, 13,691 in the UK and 8,839 in Spain – and 21,531 in the rest of Europe including – 6,729 in Portugal, 5,606 in Switzerland, 4,019 in the Netherlands, 3,459 in Sweden and 1,718 in Denmark – which are complemented by 1,971 broadcasting and other sites, and 13,858 DAS and Small Cell nodes.

Financial management, portfolio optimisation, and shareholders return

In line with its strategy to optimise its operational footprint, Cellnex completed the sale of 100% of its Austrian business in late 2024 to a consortium formed by Vauban Infrastructure Partners, EDF Invest, and MEAG. In February 2025, it finalised the divestment of its Irish operations, acquired by Phoenix Tower International (PTI).

These strategic decisions support value creation for shareholders, including a share buyback program and a focus on operational efficiency, cash generation, and financial sustainability. On 18 June, Cellnex paid a dividend from share premium totalling €11.82 million, equivalent to €0.0167 per share.

As of the end of H1 2025, net bank debt stood at €17.1 billion, with a solid structure: 78% fixed-rate, providing stability against market volatility and protecting cash generation capacity.

Standard & Poor’s Global Ratings (“S&P”) has decided to improve the Cellnex rating outlook from stable to positive. This update comes along greater with flexibility in the thresholds applicable to the Company’s rating. With regards to the current Cellnex rating set at BBB- by S&P, the threshold of the leverage ratio according to the S&P methodology has increased from 6.0x-7.0x to 7.0x-7.75x.

Commitment to sustainability

Cellnex continues to advance its decarbonisation strategy, updating its SBTi validated targets and preparing for net-zero emissions validation. For the second consecutive year, Cellnex was ranked among the top 20 most sustainable companies globally (18th overall, 3rd in Spain) by Time and Statista. It was also included again in the S&P Global Sustainability Yearbook 2025, remains in the Dow Jones Europe Index, and received EcoVadis Platinum medal for the second year in a row and is a listed company by CDP and Supplier Engagement Leaderboard for the 6th and 4th consecutive years, recognising its leadership and continuous efforts in sustainability.

About Cellnex Telecom

Cellnex is Europe’s largest telecommunications towers and infrastructures operator, enabling operators to access a wide network of telecommunications infrastructures on a shared-use basis, and thus helping to reduce access barriers and to improve services in the most remote areas, whilst also contributing to more sustainable deployment. The Company manages a portfolio of more than 110,000 sites, including forecast roll-outs up to 2030, in 10 European countries, with a significant footprint in Spain, France, the United Kingdom, Italy and Poland. Cellnex, which is listed on the Spanish Stock Exchange, is part of the selective IBEX35 and Euro Stoxx 100 and enjoys outstanding positions on the main sustainability indexes such as FTSE4Good, MSCI and DJSI Europe.

To access both the supporting financial information and the consolidated financial statements, please, visit: Financial Information – Cellnex